Since that’s a lot of talk and media coverage about things like debt, deficits, and government spending, I wanted to add a few observations here.

While the Provincial and Federal governments can run deficits, Towns and Cities cannot.

Deficits occur when a Federal or Provincial government spends more on their services and projects during their fiscal year than their revenue for that year. The new Federal government, for example, just announced that they expect to end their fiscal year with a $3.0 billion deficit. Adding up this overspending is called an accumulated deficit or Federal / Provincial debt. And, that Federal and Provincial debt includes both operating costs (program spending) and capital expenditures.

On the other hand, Towns and Cities must run balanced books each year. We cannot budget for a deficit nor a surplus, nor can we accumulate deficits.

So, how do we mitigate unexpected expenses or pay for large capital projects? With reserves and municipal debt (called debentures).

Sometimes we accumulate specific funds over a few years in a reserve to help pay for something in a future year. For example, we might put $100K aside for a few years so that we can buy a $400K fire truck in year four. Or, we established a snow clearing reserve to cover excess operating costs for winter control methods (if required).

For multi-million-dollar community assets, however, it might not make sense to save up for decades in advance.

For example, does it make sense to pre-charge folks for a number of years to save up for a multi-million-dollar water or waste water project, when the asset will be used over 50 to 70 years? Why should people who move or pass away prior to a project’s construction pre-pay for an entire project? Wouldn’t it be better to allow folks benefitting from the project pay as they use it?

One could make the same case for a 40 -50-year asset like a community centre or a 25-year asset like a downtown redevelopment. It’s often in these types of cases that “smart debt” – a debenture period of less than the life of the asset – makes sense.

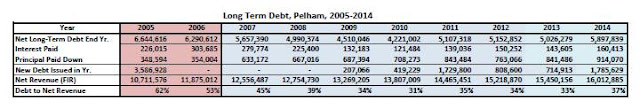

And, that’s especially beneficial during periods of low interest rates and infrastructure grants from other Governments. For example, by the end of 2014 the Town’s total long-term debt was just under $5.9 million. Last year we added nearly $1.8 million of debt to pay our share of Downtown Fonthill’s revitalization and Fire Station #2 construction after taking advantage of more than $4.1 million of Federal and Provincial stimulus funding; we also repaid $914,070 in debt principal in 2014.

I will continue to keep you informed as Council and I work to improve our infrastructure and increase the quality of life in our Town.